can i get a mortgage if i didn't file a tax return

Its perfectly legal to file a tax return even if your income falls below the IRS minimum requirement to file. Thank you for contacting us for assistance with your concern.

Delinquent Or Unfiled Tax Return Consequences For Irs Taxes

Failure to file penalties.

. Can i get a mortgage if i didnt file a tax return. September 30 2020 616 AM. The failure-to-file penalty is usually 5 for each month or part of a month that your tax return is.

Yes you can get approved for a mortgage when you owe a federal tax debt to the IRS. The lenders who offer. Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if.

Additionally you cannot get an FHA loan or a VA loan without a tax return. Not providing tax returns for getting a mortgage is not a recipe for granting a loan to consumer who has not filed a tax return. Paying the fee does not file your tax return.

For those who dont normally file a tax return the process is simple and only takes a few minutes. Welcome to JustAnswer. Lenders who provide mortgages with no tax return requirement understand that the documented earnings on your tax returns is not as essential because the amount of cash.

As an agency within the Department of Housing and Urban Development FHA guidelines require full documentation of borrower income to qualify for a government-insured. Interest and penalties accrue from your original. You have to go all the way through the FILE section and click a big orange button that says.

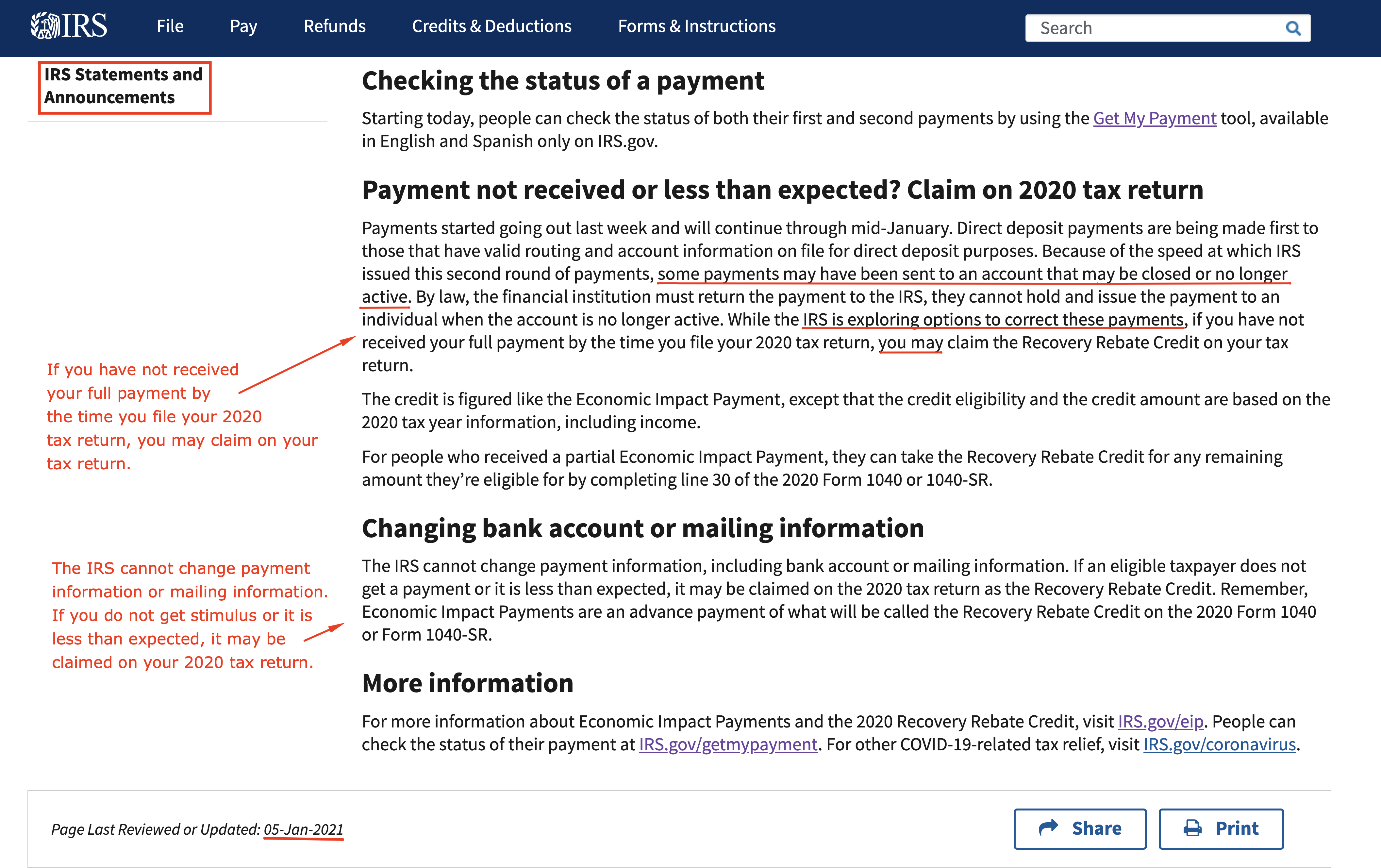

Yes you can get approved for a mortgage when you owe a federal tax debt to the IRS. First visit IRSgov and look for Non-Filers. You may be subject to the failure-to-file penalty unless you have reasonable cause for your.

However there are mortgage options for people who cannot provide tax returns or if your tax returns do not show enough income to qualify for a mortgage. These loans have low down payments of 0 to 3 which can save you a lot of money when youre buying a home. If youre asking yourself Can I get a mortgage with unfiled taxes then you should keep reading.

You can qualify for an EITC credit even if you earn as little as 1. You might not get very far with the mortgage application process if you have. Can i buy a house if i didnt file my taxes.

Im Victor and I will be happy to assist you with your question. Can i get a mortgage if i didnt file a tax return. If you were a single parent with two kids in 2021 and earned 5000 you would qualify for 2010 credit.

Failure to file penalties result in a 5 percent. If you dont file for an extension or fail to file by the extended deadline you will start to face penalties. Our 4 step plan will help you get a home loan to buy or refinance a property.

As a result even though you didnt work the mortgage interest deduction might still benefit you. 12550 for tax year. Check Your Eligibility for Free.

For example suppose you have a 15000 mortgage interest deduction and 35000 in interest. Enter Payment Info Here Then.

These 13 Tax Breaks Can Save You Money Even If You File Last Minute Cnet

When Does A Dependent Have To File A Tax Return Credit Karma

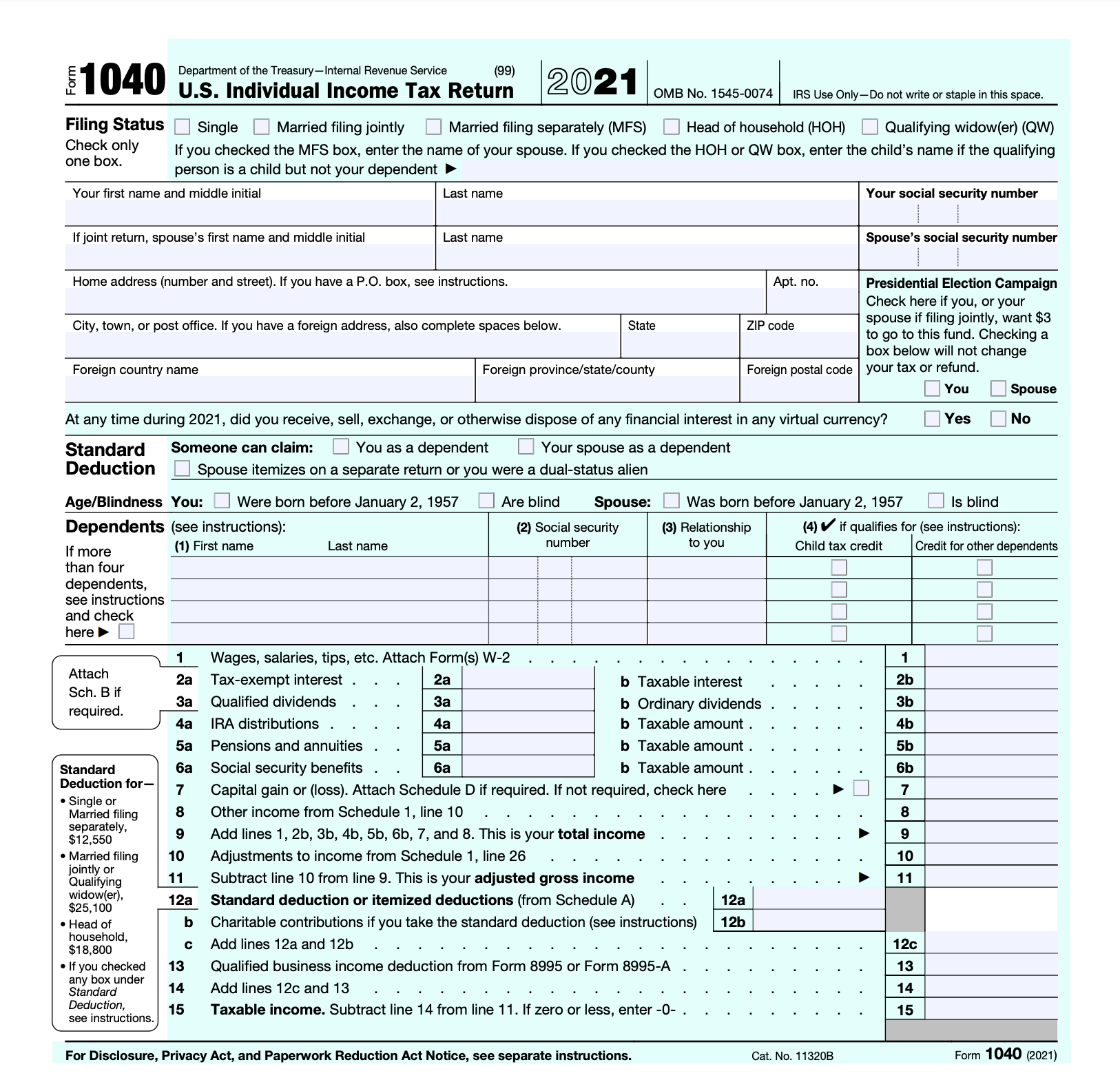

Irs Form 1040 Individual Income Tax Return 2022 Nerdwallet

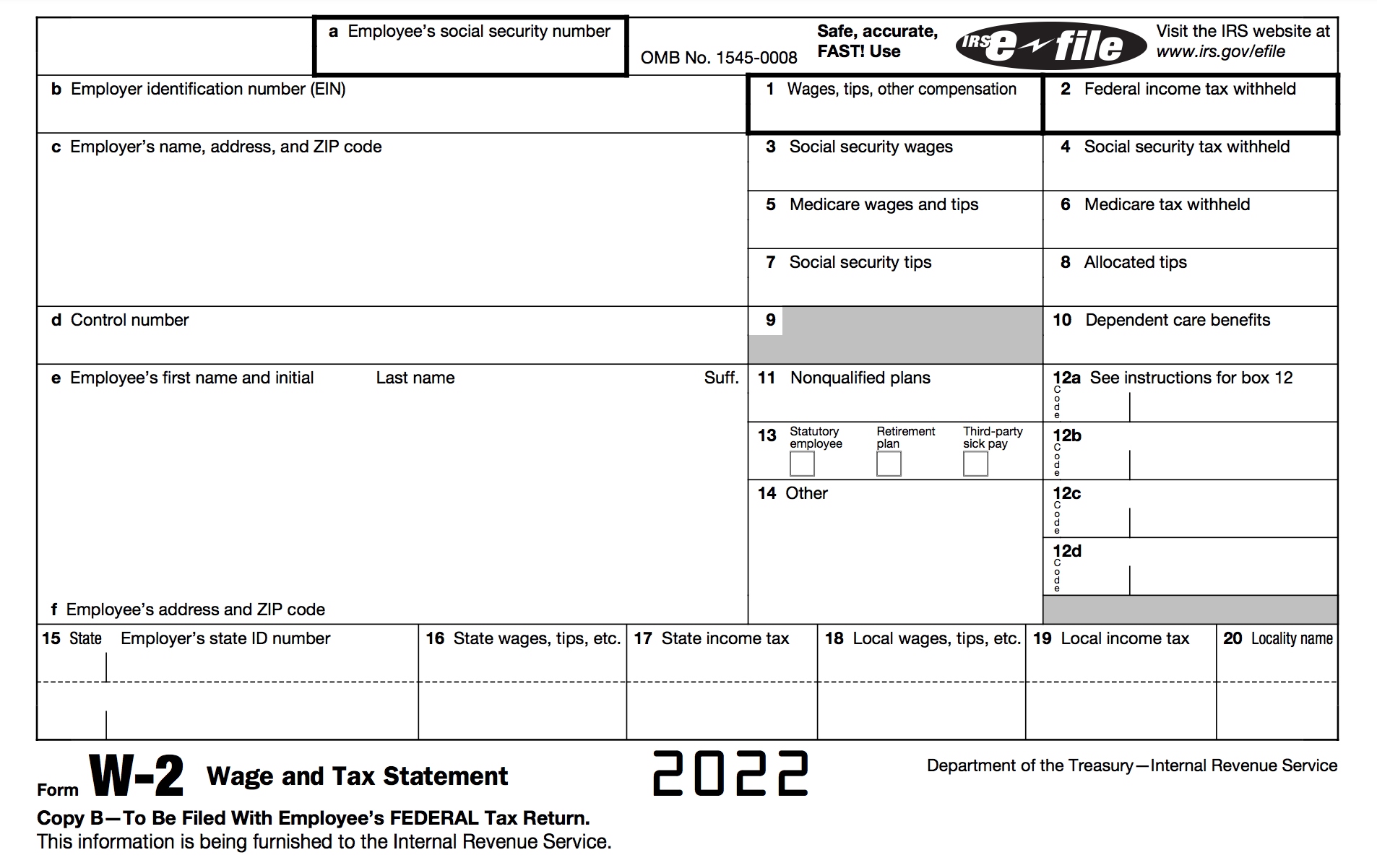

How To Fill Out A W 2 Tax Form For Employees Smartasset

Estimated Income Tax Payments For Tax Year 2023 Pay Online

What Is The Minimum Income To File Taxes Credit Karma

What To Do If Your Tax Refund Is Wrong

What Happens If I Haven T Filed Taxes In Over Ten Years

Can I File Taxes On Self Earned Income Without A 1099

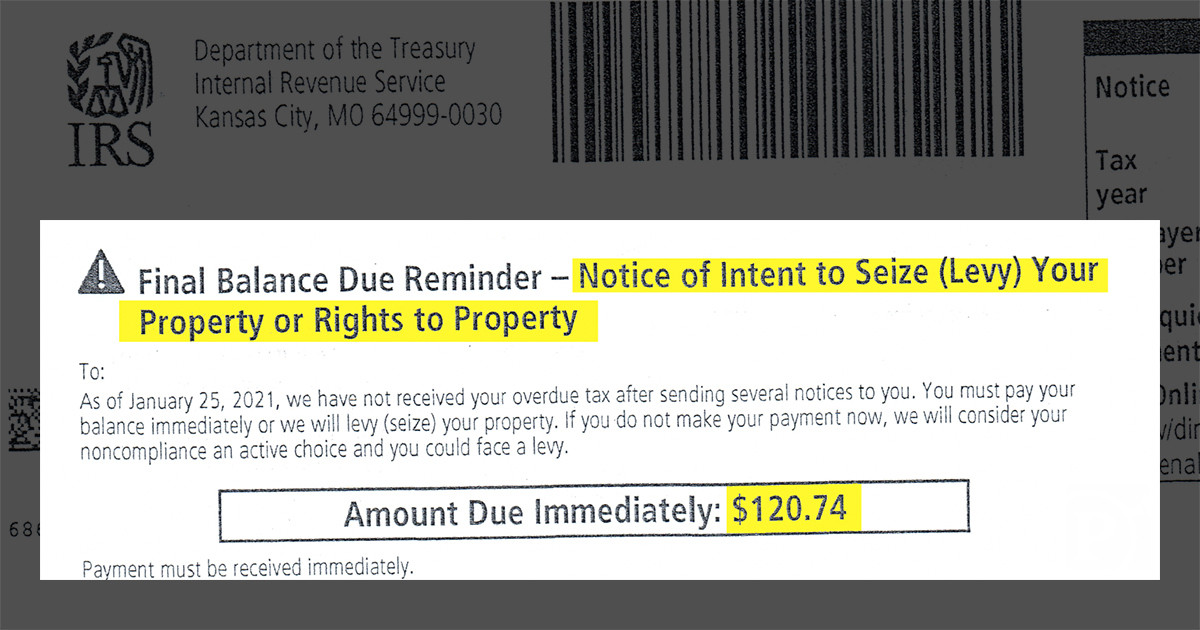

The Irs Cashed Her Check Then The Late Notices Started Coming Propublica

Tax Deductions For Home Purchase H R Block

5 Ways To Get Approved For A Mortgage Without Tax Returns

Tax Refund Status Is Still Being Processed

Here S What Happens When You Don T File Taxes

Schedule D How To Report Your Capital Gains Or Losses To The Irs Bankrate

Filing Back Taxes What To Know Credit Karma Tax